Standard deduction federal income tax 2020

The 2020 standard deduction amounts for federal income taxes have risen slightly because of inflation. CPA Professional Review.

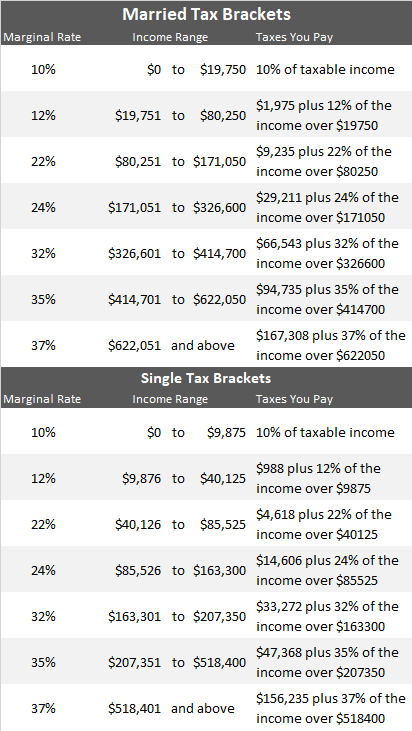

Inkwiry Federal Income Tax Brackets

Bring steadiness to comprehensive tax planning and access the projected inflation-adjusted federal tax amounts for 2023 available within hours of release by.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

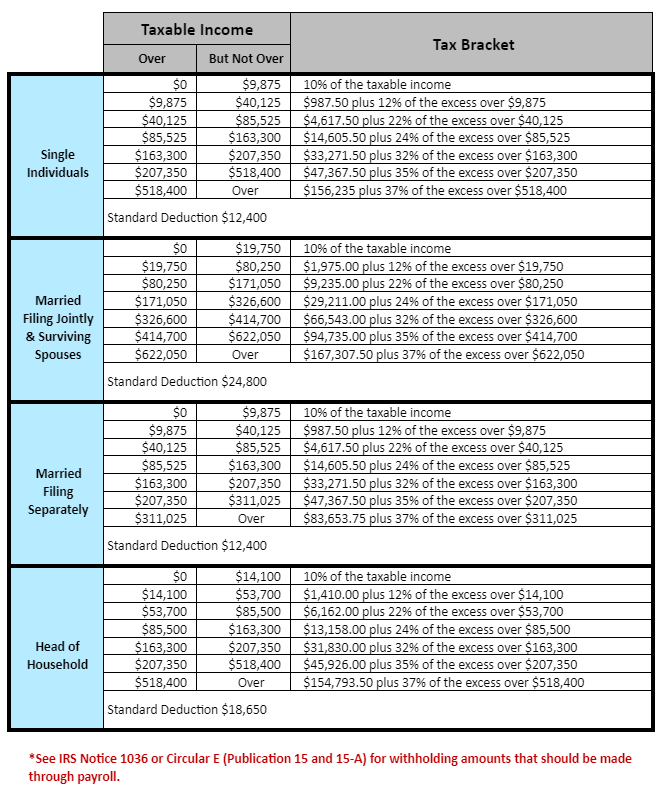

. For married individuals filing joint returns and surviving spouses. Ad Access IRS Tax Forms. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online.

Complete Edit or Print Tax Forms Instantly. Ad Prevent Tax Liens From Being Imposed On You. The standard deduction is a specific dollar amount that reduces the amount of income on which youre taxed.

10 12 22 24 32 35 and 37. The standard deduction for the year 2020 is 12000. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Inflation adjusted amounts in the tax code will increase by roughly 71 from 2022 more than double last years increase of 3 according to the 2023 Projected US. How Much Is My Standard Deduction. After subtracting the standard deduction of 25100 your taxable income for 2021 is 64900.

Like all tax deductions the standard deduction reduces the amount of. Ad Fill out form to find out your options for FREE. Married couples who file joint tax returns have a 2022 standard.

On a federal level the IRS allows the taxpayer to deduct 12550 from this meaning only 7450 of. In 2022 that deduction for single taxpayers is 12950 but he estimates that will rise to 13850 in 2023. The standard deductions for individuals will be 12000 in 2020.

The tax is 10 of. That puts you in the 12 tax bracket. If taxable income is under 22000.

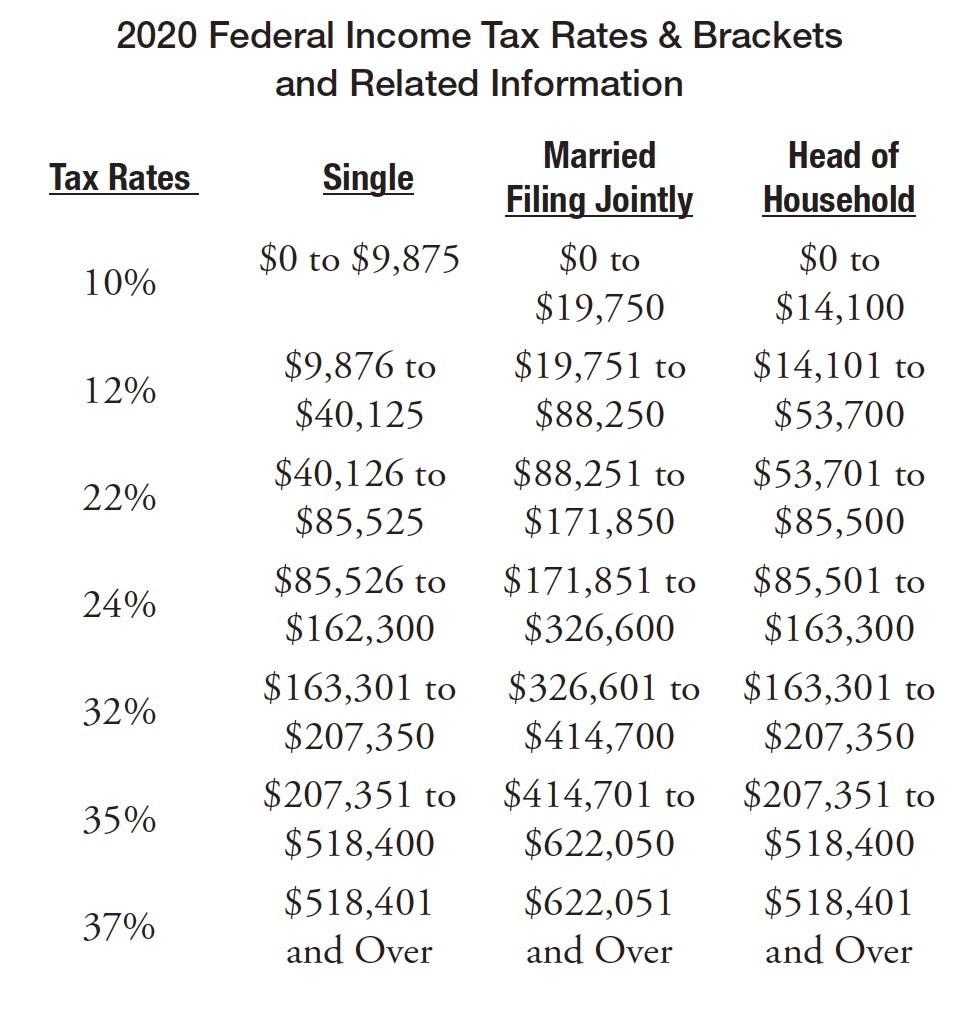

The tax rate schedules for 2023 will be as follows. The federal tax brackets are broken down into seven 7 taxable income groups based on your filing status. To calculate your tax bill youll pay 10 on the.

The size of your standard deduction depends on a few factors. IRS standard deduction Earned Income Tax Credit EIC. Get an overview State Income Tax Brackets and Standard Deductions.

Your age your income and your filing status. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

The tax rates for 2020 are. Maximize Your Tax Refund. Under United States tax law the standard deduction is a dollar amount that non-itemizers may subtract from their income before income tax but not other kinds of tax such as payroll tax is.

This is an increase from the 6500 that was set in 2019.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

2021 Tax Brackets Standard Deductions Dsj Cpa

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Tax Rates Standard Deductions Heemer Klein Cpas

2021 Tax Brackets Standard Deductions Dsj Cpa

Tax Rates Standard Deductions Heemer Klein Cpas

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Standard Deduction Definition Taxedu Tax Foundation

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Federal Personal Income Tax Rates Schedule 1 Haefele Flanagan

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

Your Guide To 2020 Federal Tax Brackets And Rates

2021 Tax Thresholds Hkp Seattle

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc